Max Traditional Ira Contribution 2024 Over 50. 2024 ira contribution limits over 50 emelia, ira contribution limits 2024 over 50 years. The maximum amount you can contribute to a roth ira in 2023 is $6,500, or $7,500 if you’re age 50, or older.

But it’s important to consider the exceptions to these contribution limits and the consequences if you exceed them. $6,500 ($7,500 if you’re age 50 or older), or.

For 2023, The Annual Contribution.

$7,000 ($8,000 if age 50 or over)

And Don't Forget To Reach Out To Tax Professionals For Tax Advice.

The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year was $6,500 or $7,500 if you were age 50 or older.

The Cap Applies To Contributions Made Across All Iras You Might Have.

Images References :

Source: berthaqdiannne.pages.dev

Source: berthaqdiannne.pages.dev

Ira Maximum Contribution 2024 Letti Olympia, The total employee contribution limit. If you're age 50 and older, you can add an extra $1,000 per year.

Source: sonnniewbriana.pages.dev

Source: sonnniewbriana.pages.dev

Max Ira Contribution 2024 Roth Ira Growth Nance Valenka, And don't forget to reach out to tax professionals for tax advice. The annual contribution limit for a traditional ira in 2023 was.

Source: celestawjeanna.pages.dev

Source: celestawjeanna.pages.dev

401k 2024 Contribution Limit Over 50 Dodi Nadeen, For 2024, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2023. Updated on december 22, 2023.

Source: carminawevvy.pages.dev

Source: carminawevvy.pages.dev

2024 Traditional Ira Contribution Limits Over 50 Lia, The 2024 contribution limits are as follows:. The maximum total annual contribution for all your iras (traditional and roth) combined is:

Source: www.advantaira.com

Source: www.advantaira.com

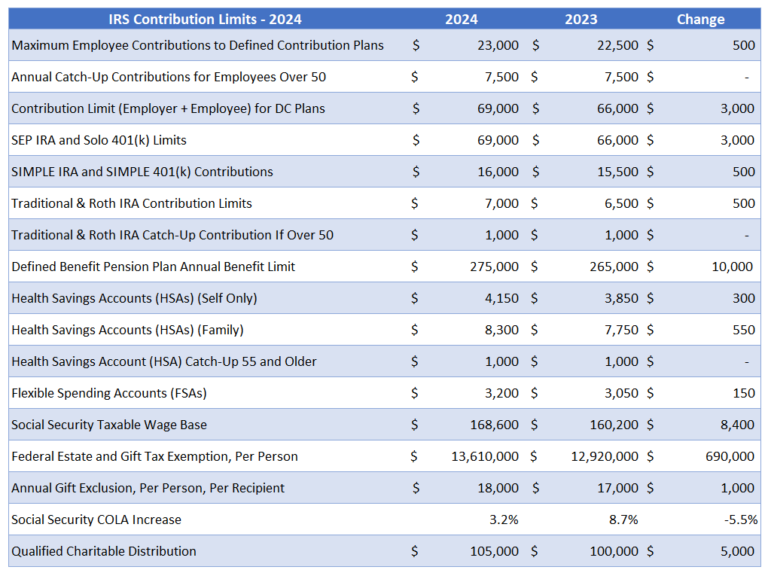

2024 Contribution Limits Announced by the IRS, Max ira contributions for 2024 tommy gretchen, so, workers age 50 and up can contribute a maximum of $30,500 to their roth 401 (k) in 2024. The roth ira contribution limit for 2023 is $6,500 for those under 50, and $7,500 for those 50 and older.

Source: meldfinancial.com

Source: meldfinancial.com

IRA Contribution Limits in 2023 Meld Financial, $6,500 ($7,500 if you're age 50 or older), or. The 2024 contribution limits are as follows:.

Source: directedira.com

Source: directedira.com

Contribution Limits Increase for Tax Year 2024 For Traditional IRAs, Updated on december 22, 2023. As a couple, you can contribute a combined total of $14,000 (if you're both under 50) or $16,000 (if you're both 50 or older) to a traditional ira for 2024.

Source: jesselynwsalli.pages.dev

Source: jesselynwsalli.pages.dev

When Will Irs Announce 401k Limits For 2024 Cindy Deloria, $6,500 ($7,500 if you're age 50 or older), or. Contributions to a traditional ira are not limited by how much you earn each year, but the irs does limit the amount of money you can contribute to your traditional ira annually.

Source: www.youtube.com

Source: www.youtube.com

2024 IRA Maximum Contribution Limits YouTube, Morgan professional to begin planning your 2024 retirement contributions. The maximum amount you can contribute to a roth ira in 2023 is $6,500, or $7,500 if you’re age 50, or older.

Source: cheryqstephie.pages.dev

Source: cheryqstephie.pages.dev

Tsp Roth Max Contribution 2024 Kelsy Mellisa, According to the fidelity ® q2 2023 retirement analysis, roth iras are now the most popular way to save for retirement outside of a workplace plan. For 2024, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2023.

For 2024, You Can Contribute Up To $7,000 In Your Ira Or $8,000 If You’re 50 Or Older.

$7,500 (for 2023) and $8,000 (for 2024) if you're age 50 or older;

People Under Age 50 Can Generally Contribute Up To $7,000 Per Year To Their Roth Iras.

Here’s a look at the traditional ira contribution limits for 2023.